The online investing world is full of bold promises, complex tools, and confusing terminology. This platform positions itself as a smart digital assistant that helps users approach crypto and other markets with automated strategies and data-driven insights. Instead of staring at charts all day, the idea is to let the system handle most of the analysis while you focus on your overall goals and risk limits.

In this 2025 review, we’ll walk through how the service presents itself, what you can expect during onboarding, which features are highlighted, and what kind of user it may suit. You’ll also find an honest look at potential downsides and red flags to consider before you decide whether to engage with the service or not or visit the Mark Carney Official Website for further background. By the end, you’ll be better prepared to decide if it deserves your contact details and a conversation with a human consultant – or if you should keep looking at other options.

Introduction

The central promise of this platform is simple: make modern markets more accessible to regular people by using algorithms, automation, and risk tools that were once reserved for professionals. The service promotes itself as a bridge between complex trading environments and users who may not have years of experience but still want exposure to digital assets and other instruments.

Rather than forcing you to become a technical analyst overnight, the system focuses on guided setup, pre-defined strategies, and human support. Visitors are encouraged to submit a short form, after which a representative reaches out to explain how the service works, what the risks are, and what account setup may involve.

Key Facts

Before engaging with any online trading service, it’s important to understand a few core points. This platform is presented as a web-based solution that connects users to third-party brokers and market venues. It does not usually act as the direct holder of client funds; instead, accounts are typically opened with partner institutions that handle deposits and withdrawals.

Access is offered in multiple regions, though availability can vary depending on local regulations and broker partnerships. The minimum deposit, payment methods, and supported instruments may differ from one partner to another. The service is designed for speculative trading, not for guaranteed returns or savings products. All trading involves risk, and there is always a real possibility of losing money.

What Is Mark Carney Investment Platform?

At its core, this is a technology layer built to sit between you and the markets. It combines automated signal generation, portfolio tools, and a streamlined dashboard into a single interface. Instead of manually scanning markets, the system aims to highlight potential opportunities based on predefined rules and live data.

The brand focuses heavily on simplicity: a clear overview of open positions, balance, and recent performance, plus direct access to support staff from the partner broker or onboarding team. It is not a magic money machine, but rather a tool that tries to reduce the workload involved in strategy execution and day-to-day monitoring. How effective it is will depend on market conditions, your risk appetite, and how you configure it.

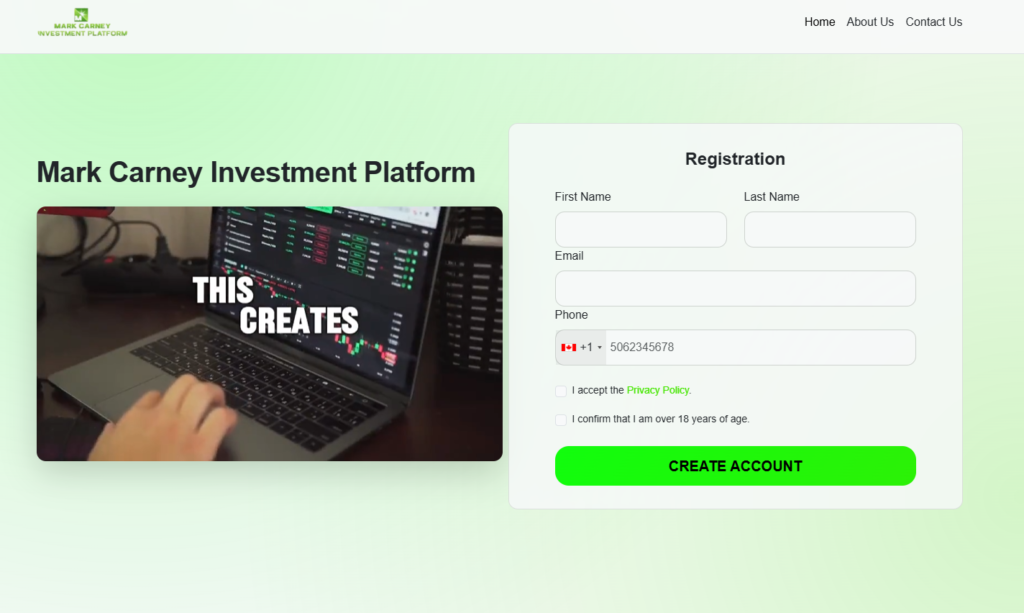

How to Get Started With Mark Carney Investment Platform

The typical entry point is a registration form on the official website. New visitors are asked to share basic contact details so that a representative can reach out by phone or email. During this initial conversation, they usually explain the platform’s features, answer questions about the dashboard, and outline the next steps for creating a live account with a partnered broker.

If you decide to move forward, the broker will generally request identity verification and may ask for additional documents to comply with local regulations. After your account is approved and funded, credentials are linked to the trading interface. From there, you can explore the tools, adjust risk settings, and decide whether to activate any automated modes provided. If you are under 18 or unsure about any step, you should involve a parent, guardian, or licensed financial professional before proceeding.

Is Mark Carney Investment Platform Legit or a Scam?

The question of legitimacy depends on several factors: who the underlying broker is, whether that broker is regulated in your country, and how transparent the service is about risks and fees. A serious operation will clearly disclose its partners, show legal information in the footer, and encourage users to check regulatory registers.

On the other hand, you should be cautious if you encounter aggressive promises, pressure to deposit quickly, or guarantees of high returns with little or no risk. Legitimate services do not need to rush you or hide their legal details. Before sharing money or sensitive data with any online trading environment, independently verify the registration status of the broker and read neutral third-party feedback. Treat this review as a starting point, not a final verdict.

How Mark Carney Investment Platform Works

Once your account is connected, the interface pulls market data and trading information from the partnered broker. You can usually see charts, open and closed positions, available balance, and performance summaries in one place. The system can generate signals based on patterns, volatility, or other technical indicators configured behind the scenes.

Depending on your settings, the platform may be used either for manual decision-making or for semi-automated order placement. In manual mode, you review signals and decide which ones to follow. In more automated modes, the system can place and manage trades according to predefined parameters, such as maximum risk per position or daily exposure limits. You retain the ability to pause or adjust these settings at any time through the dashboard.

Core Features of Mark Carney Investment Platform

One of the key selling points is a user-friendly interface that aims to simplify access to multiple markets from a single screen. Real-time quotes, basic charting tools, and account information are presented in a way that new users can understand without feeling overwhelmed.

Another common feature is strategy automation. Instead of building custom scripts from scratch, users are typically offered ready-made configurations that follow certain rules around entries, exits, and risk. Some setups may focus on shorter-term moves, while others target broader trends. Educational materials, onboarding calls, or webinars may also be available to help you understand how to navigate the environment more confidently.

Who Is Mark Carney Investment Platform Best For?

This kind of service is generally aimed at adults who are curious about speculative markets but do not want to spend all day learning complex technical skills. It may appeal to people who are comfortable with digital tools, willing to accept the possibility of losses, and looking for a more guided experience than a traditional bare-bones broker.

It is not suitable for anyone seeking guaranteed income, fixed returns, or risk-free investing. If you are still in school, under 18, or using money you cannot afford to lose, trading through any online system is not a good idea. In those situations, it is far better to focus on learning the basics of personal finance and discuss long-term planning with trusted adults.

Tips for Getting the Most Out of Mark Carney Investment Platform

To use any trading technology responsibly, start by defining a clear risk limit and sticking to it. Decide in advance how much of your capital you are willing to expose and what level of drawdown would trigger a pause. Never feel pressured to deposit more just because a representative suggests it; your financial boundaries should come first.

Next, treat the tools as decision support, not as infallible predictors. Take time to understand what each mode does, test with smaller amounts, and review results over a meaningful period. Regularly withdraw a portion of any profits instead of constantly increasing position sizes. Finally, stay alert to warning signs such as unsolicited requests for remote access to your computer, demands for additional payments to “unlock” funds, or refusal to process withdrawals-these are red flags that should not be ignored.

Safety, Security, and Compliance

Responsible services usually encrypt data, require secure logins, and follow know-your-customer and anti-money-laundering rules through their broker partners. Before creating an account, check whether the login page uses secure protocols, how your documents are stored, and what measures are in place to protect personal information.

Compliance is just as important as technical security. Always confirm whether the broker connected to the platform is supervised by a recognized authority in your country or region. Read the terms and conditions carefully, paying special attention to how disputes, margin calls, and account closures are handled. If anything is unclear, ask for clarification in writing or consult an independent professional.

Performance and Benefits of Mark Carney Investment Platform

No online trading environment can honestly guarantee specific results, because markets are unpredictable and influenced by many external factors. The potential benefit of this system lies in its attempt to streamline analysis, automate repetitive tasks, and make risk management more visible. For some users, that structure can help avoid purely emotional decisions and bring more discipline to their approach.

However, performance will always vary from person to person. Your outcomes depend on deposit size, strategy choices, risk levels, and how long you stay active. The most realistic way to view the platform is as a set of tools and services that may or may not fit your needs and risk tolerance. Before committing serious capital, use initial conversations with the team to ask detailed questions, compare with other providers, and decide whether booking a call and completing the form is truly in your best interest.